In the highly competitive field of agency recruitment, success hinges on more than just instincts or experience. It requires a deep understanding of measurable performance indicators that highlight strengths, uncover weaknesses, and provide actionable insights to improve outcomes. For agency recruiters and search consultants, tracking key metrics is not just a best practice—it’s a strategic advantage.

In this article, we will explore the key metrics every recruiter should track, explaining why they matter and how to leverage them for better results.

The Importance of Metrics in Recruitment

Metrics are the backbone of any data-driven recruitment strategy. They allow recruiters to gauge efficiency, measure success, and make informed decisions. Without tracking metrics, it’s impossible to identify bottlenecks in your processes or pinpoint areas for improvement. Metrics not only provide clarity but also help build credibility with clients by showcasing the tangible value you deliver. In an industry where outcomes matter most, understanding and optimizing key performance indicators (KPIs) can be the difference between an average placement record and exceptional success.

Moreover, metrics allow for scalability. As agencies grow, having measurable insights ensures that processes remain efficient and consistent across larger teams. Metrics also enable predictive analytics, helping agencies anticipate future challenges and align their strategies accordingly. In essence, metrics bridge the gap between strategy and execution, making them indispensable for modern recruitment agencies.

Metrics to Evaluate the Candidate Pipeline

Time-to-Fill

Time-to-fill measures the time it takes from when a job requisition is opened to when a candidate accepts an offer. This metric is critical because it directly impacts client satisfaction. Employers want roles filled quickly to avoid productivity gaps and additional costs. A long time-to-fill can signal inefficiencies in your sourcing, screening, or interview scheduling processes.

To improve your time-to-fill, analyze each stage of the hiring funnel. Are candidates dropping off during interviews? Are you spending too much time waiting for client feedback? Addressing these bottlenecks can significantly reduce the time required to fill roles. In addition, using technology such as applicant tracking systems (ATS) or scheduling automation tools can help streamline processes. Regularly reviewing your time-to-fill across different industries or roles can also provide insights into areas where specialized strategies may be required.

Application-to-Interview Ratio

This metric tracks how many candidates move from the application stage to the interview stage. A low ratio may indicate that your sourcing efforts are not targeting the right talent pool or that job descriptions are unclear. Conversely, a high ratio suggests that your screening criteria are effective, and your outreach is resonating with the right candidates.

Improving this ratio requires collaboration with clients to refine job descriptions and ensuring that your sourcing strategies are focused on the most relevant channels. Regularly reviewing this metric ensures your pipeline remains healthy and aligned with client expectations. Also, using tools like AI-driven resume screening can help identify the most qualified candidates, enhancing the application-to-interview ratio.

Offer Acceptance Rate

Offer acceptance rate measures the percentage of candidates who accept the offers extended to them. This is a critical indicator of how well you’re matching candidates with roles and aligning their expectations with client offerings. A low acceptance rate may suggest issues such as unrealistic salary expectations, misaligned job descriptions, or poor communication throughout the hiring process.

To boost offer acceptance rates, maintain clear and open communication with both candidates and clients. Ensure candidates are fully informed about the role, company culture, and compensation package before extending an offer. In addition, advising clients on market trends and competitive salary benchmarks can make their offers more attractive. Conducting regular follow-ups with candidates to address concerns or clarify expectations can also contribute to higher acceptance rates.

Metrics for Assessing Client Satisfaction

Client Retention Rate

Client retention rate reflects the percentage of clients who return to you for additional hiring needs. A high retention rate is a clear indicator of trust and satisfaction. Conversely, a low retention rate may suggest that clients are dissatisfied with your service or the quality of placements.

To improve client retention, focus on building strong relationships through consistent communication, delivering high-quality candidates, and providing additional value, such as market insights or hiring trend reports. Following up after placements to ensure client satisfaction can also strengthen long-term partnerships. Offering post-placement support, such as onboarding assistance or follow-up check-ins, further demonstrates your commitment to client success.

Fill Rate

Fill rate measures the percentage of job requisitions you successfully fill for a client. This metric is a direct reflection of your ability to deliver results. A low fill rate may indicate inefficiencies in your processes, such as misaligned expectations, insufficient sourcing efforts, or poor communication with clients.

Improving fill rates requires close collaboration with clients to ensure you understand their needs and expectations. Setting realistic timelines and maintaining open lines of communication throughout the process are essential for meeting placement goals. Also, investing in talent pipeline growth and leveraging specialized sourcing channels can help increase your fill rate. Regularly revisiting client feedback can also provide insights into areas where adjustments may be necessary.

Metrics for Evaluating Recruiter Efficiency

Submittals-to-Hire Ratio

The submittals-to-hire ratio measures how many candidate profiles you need to submit before making a successful placement. This metric reveals the effectiveness of your screening and selection processes. A high ratio may indicate that too many unqualified candidates are being submitted, which can frustrate clients and reduce trust.

To improve this ratio, refine your screening criteria and ensure you’re presenting only the most relevant candidates to clients. Investing time in understanding client expectations and aligning your candidate profiles with those expectations can significantly improve this metric. Leveraging technology, such as predictive analytics tools, can further enhance your ability to identify high-quality candidates.

Candidate Response Time

Candidate response time tracks how quickly candidates respond to your outreach. A slow response time can delay the hiring process and frustrate clients. This metric is particularly important in competitive industries where top talent is in high demand.

To improve response times, use personalized outreach messages that immediately capture candidates’ attention. Leveraging automation tools can also help you follow up with candidates promptly, ensuring they remain engaged throughout the hiring process. Building strong relationships with candidates by offering value—such as career advice or market insights—can also encourage quicker responses.

Cost-Per-Hire

Cost-per-hire measures the total cost associated with filling a role, including advertising, recruiter salaries, technology expenses, and other overhead costs. This metric is essential for understanding the financial efficiency of your recruitment process. A high cost-per-hire may indicate inefficiencies or overreliance on expensive sourcing methods.

To reduce cost-per-hire, optimize your sourcing channels, use technology to streamline administrative tasks, and focus on building a strong talent pipeline that minimizes the need for expensive job advertisements. Partnering with clients to clearly define job requirements upfront can help reduce unnecessary expenditures.

Metrics for Long-Term Success

Candidate Retention Rate

Candidate retention rate measures how long placed candidates remain with their new employers. This metric is a strong indicator of the quality of your placements and the accuracy of your candidate matching process. A low retention rate suggests that candidates are not well-suited for the roles or organizations.

Improving retention rates requires a thorough understanding of both the client’s needs and the candidate’s career goals. Conducting in-depth interviews, assessing cultural fit, and providing detailed candidate profiles to clients can significantly enhance retention rates. In addition, offering post-placement support, such as coaching or check-ins, can help ensure a smooth transition for candidates.

Placement Satisfaction Score

Placement satisfaction score measures how satisfied clients and candidates are with the placement. Collecting feedback through surveys or follow-up calls helps you understand areas for improvement and build stronger relationships.

To achieve high satisfaction scores, maintain transparency throughout the recruitment process, set realistic expectations, and provide ongoing support to both clients and candidates after placements. Creating a feedback loop ensures you’re continuously refining your process based on input from stakeholders.

Metrics for Market Competitiveness

Sourcing Channel Effectiveness

This metric evaluates the success of different sourcing channels, such as job boards, social media, referrals, or professional networks. Understanding which channels yield the best results allows you to allocate resources more effectively and focus on high-performing strategies.

Regularly review the performance of your sourcing channels and experiment with new ones to stay competitive. Building strong relationships with industry associations and attending networking events can also expand your talent pool. Analyzing metrics such as the cost-per-applicant or applicant-to-interview ratio for each channel can provide deeper insights into their effectiveness.

Talent Pipeline Growth

Talent pipeline growth measures the increase in the number of qualified candidates in your database over time. A growing pipeline indicates that your sourcing efforts are effective and that you’re well-positioned to meet future hiring demands.

To grow your pipeline, engage in proactive outreach, build strong relationships with passive candidates, and maintain regular communication with your network. Offering career resources or hosting webinars can also attract potential candidates to your database. Tracking the diversity of your pipeline can ensure you’re meeting clients’ goals for inclusive hiring.

Using Metrics to Drive Continuous Improvement

Tracking metrics is only the first step. To truly benefit from data-driven recruitment, you must use these insights to drive continuous improvement. Regularly analyze your metrics to identify trends, evaluate the effectiveness of your strategies, and make adjustments as needed. For example, if your time-to-fill is consistently high, it may be worth reevaluating your sourcing channels or improving collaboration with clients.

Metrics also play a critical role in goal setting. Establishing clear, measurable objectives based on your KPIs ensures that you and your team remain focused on achieving results. Regularly reviewing your progress against these goals helps maintain accountability and keeps your recruitment efforts on track.

Building a Culture of Data-Driven Recruitment

Creating a culture of data-driven recruitment within your agency requires buy-in from all team members. Encourage your recruiters to take ownership of their metrics and provide training on how to analyze and interpret data. Sharing success stories that highlight the impact of metrics on recruitment outcomes can also inspire your team to embrace this approach.

Equipping your agency with the right tools is another essential step. Investing in applicant tracking systems (ATS), customer relationship management (CRM) software, and analytics platforms ensures that you have the infrastructure needed to track and analyze metrics effectively. These tools not only simplify data collection but also provide actionable insights that drive better decision-making.

Hit Key Metrics with TE Recruit!

Tracking key metrics is vital for agency recruiters and search consultants to refine their processes and achieve better outcomes. TE Recruit by Top Echelon, an all-in-one ATS and CRM tailored for recruiting agencies, provides the tools you need to effectively monitor and optimize your performance metrics.

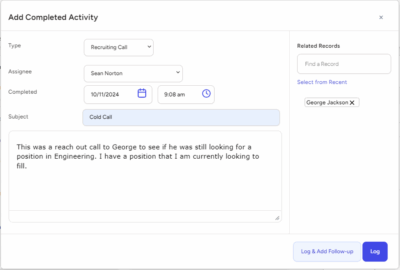

TE Recruit offers advanced reporting and analytics features that give you real-time insights into essential KPIs, such as time-to-fill, submittals-to-hire ratios, and offer acceptance rates. With a centralized dashboard, recruiters can effortlessly track every stage of the hiring funnel, identify bottlenecks, and make data-driven decisions to improve efficiency. The platform’s customizable reporting tools allow you to generate detailed metrics that align with your agency’s goals, providing a clear view of your success and areas needing attention.

TE Recruit streamlines communication and collaboration within your team, enabling everyone to share feedback and contribute to better client and candidate outcomes. Its integration with email and scheduling tools ensures all interactions are logged, helping you measure response times and track engagement effectively.

By leveraging TE Recruit’s robust capabilities, agency recruiters can transform raw data into actionable insights, drive continuous improvement, and showcase measurable value to their clients. The result is a more efficient, transparent, and impactful recruitment process that sets your agency apart.

Request a live demo today of TE Recruit by Top Echelon today and see how it can revolutionize the way you track and act on your key metrics!